Accounting is an important and vital part of every business nowadays but have you ever thought how we’ve managed to get here? Although accounting has been around for a long time it’s changed dramatically over the years with the introduction of computers. Let’s start from the beginning of accounting way back in 1494.

A Brief History of Accounting

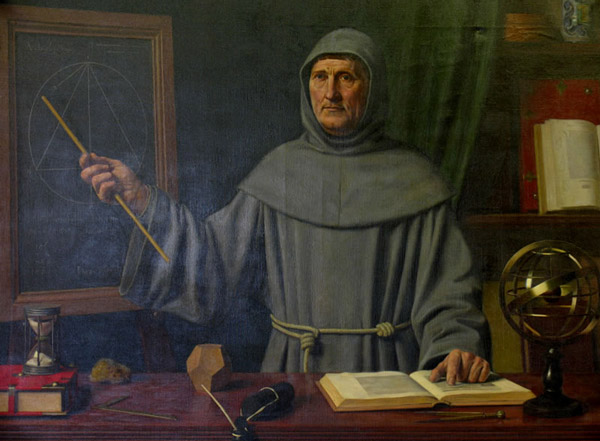

The first ever recorded form of accounting was back in 1494 when an Italian mathematician, Luca Pacioli released his book titled Summa de arithmetica, geometria. Proportioni et proportionalita.

Luca Pacioli is often referred to as “The father of accounting and bookkeeping” as he was the first person to publish work on the double entry system of bookkeeping. His book contained prints on algebra as well as how merchants could use his system to record their financial data. By using the journals and ledgers he described in his book merchants could check that their debts equalled their credits (which is very important!).

Originally printed and released in Italy the book soon spread and was published all throughout Europe, quickly becoming a best seller. The system introduced by Luca all those years ago is still used today! Although there have been a few changes over the generations the foundations of the double entry system are still visible today.

Legislation History

Another important part of accounting is the structure of a company and how that company is formed. Today you can run a business as a sole trader or register your business as a limited company. These types of companies might sound obvious today but a few hundred years ago there was no such thing.

Back in 1844 there was an Act of Parliament that allowed companies owned by one or more individuals to be incorporated. This act known as The British Joint Stock Companies Act was introduced to help increase the honesty and integrity of businesses.

Before this act was introduced many businesses operated with thousands of members of management and with little regulation. If a customer had a complaint or grievance then they were required to take legal action against every member. With some companies having thousands of members this was basically impossible to do. The new act made it safer for consumers when buying from businesses knowing somebody could be held responsible if they were not happy.

Shortly after this act was introduced, another act in 1855 was introduced to help protect the individual owners and directors of a business. The 1855 Limited Liability act limited all liabilities of a business to just within the business. Before this if a business went bankrupt the owner would still be responsible for paying out but the new act changed this.

Accounting Standards

By the time the 1900’s had begun accounting was in full swing and all legal businesses were producing accounts. There was a small problem however. Since there was no accounting standards in place, many companies looked more successful than they actually were. Thanks to “creative accounting” many accountants were able to fiddle the numbers (which was perfectly legal at the time). Many companies would look very profitable and attract a lot of investment, only to go bankrupt a few months later. Something had to be done to make sure everyone was following certain rules and guidelines.

In the late 1930s a self-regulatory body was set up to try and eliminate a number of questionable accounting practises. Although the overall committee was successful and reduces the number of businesses going bankrupt, it did not provide an underlying accounting theory for good practise.

This good practise theory was introduced in 1953 when the committee on accounting procedures produced a framework of guidelines for financial accounting. This framework known as the Generally Accepted Accounting Principles (GAAP) contains rules and structures on how to record transactions and prepare financial statements. The framework has been updated over the years and is still used this very day.

Computerised Accounts

The first ever recorded use of computerised accounts was back in 1953 when General Electric implemented an automated payroll system on their site. Back then computers were massive and basically took up the entire room. But at least it saved crunching all the numbers manually!

Back in the 60’s computers were very expensive and not every business could afford one to do their accounts. In fact for one computer it used to cost around £10,000! It was only in the mid 80’s when computers and accounting software became affordable for businesses. This meant practically everyone in the office had a computer and was able to process accounts using software. By the late 90’s professional accounting software was introduced that allowed businesses to speed up the process of preparing their financial accounts. Software such as SAGE was released that is still one of the most commonly used software today.

Cloud Accounting

Although it seems only a few years ago when the first accounting software was released, already a lot has changed in the accounting world. The introduction of cloud accounting is the newest change in the accounting world and is likely to pave the path for future changes.

Cloud accounting allows employees, bookkeepers and accountants to all access the software and data simultaneously. This allows people from within a business to enter daily transactions and all that information is sent over to the accountants who can process the data on their end. All the data is also stored online meaning if there are ever any accidents then all the data will be safe.

What Does the Future Hold?

Although the future is unknown there are a few predictions we can make about the upcoming changes in accounting. With the rate technology is advancing such as the introduction of automatic driving cars its likely artificial intelligence will start to impact other industries soon.

Imagine accounting software that does all the work for you? Unfortunately that might be a while off for now but luckily we’re here to help.

Here at CRBH we offer all the accounting services a small business would require. From payroll management to end of year financial statement preparation, we offer everything to ensure your business is operating efficiently. To see how we can help your business grow contact us for a free consultation.

Leave A Comment