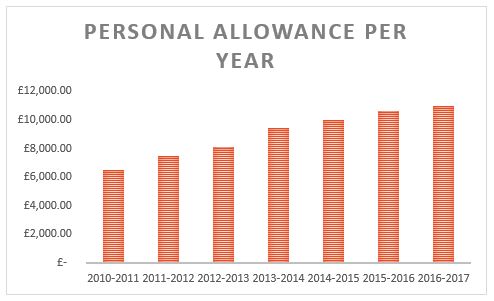

Changes to Personal Allowance 2017 – 18

The personal allowance has moved dramatically under the conservative rule. When they first took office in 2010 it was just £6,475. The personal allowance for the 2016/17 year is now £11,000 and the 2017/18 tax year it’s raising again to £11,500. The changes to the personal allowance from 2010 to 2018 have been graphed below using the figures from here.

By the end of parliament the conservatives would like to further raise the personal allowance to £12,500.

Changes to Higher Rate Threshold 2017

These changes also have an impact on the higher rate threshold. Currently any money earned over £43,000 faces a tax rate of 40%. This will be increased to £45,000 in the 2017/18 tax year and then further increased to £50,000 before the end of parliament. This is estimated to benefit higher rate tax payers by increasing their average real gains by £233 per annum.

What the changes to the Personal Allowance mean

These personal allowance changes will take over half a million of people out of taxation by the 2017/18 tax year. This means most people in Britain will pay less tax and keep more of their money. It’s estimated that over 24 million basic tax payers will benefit from this change and around 1.6 million individuals will be worse off because of these changes. The expected average real gains benefit is around £56 per annum.

The budget made further changes to the Capital Gains tax allowance and the Personal Savings allowance which will further benefit lower earners. You can find out how all these changes affect you by using the Income Tax Calculator from the Telegraph.

If you want to find out how the personal allowance changes will directly affect you or would like to discuss taxation, finance or accounting in more detail than contact CRBH today for a quick chat.

Leave A Comment